Originally published in Forbes

As the United States and world head into an economic downturn fueled by the coronavirus (COVID-19) pandemic, federal officials are enacting direct subsidies to consumers and businesses to stave off recession.

But in their rush to prop up the U.S. economy, are policymakers overlooking low-cost actions that could unlock billions in annual investment and tens of thousands of new jobs from renewable energy?

Offshore wind, one of the country’s fastest-growing energy industries, promises carbon-free electricity along with up to 83,000 high-paying jobs and up to $25 billion in economic revitalization.

Today In: Energy

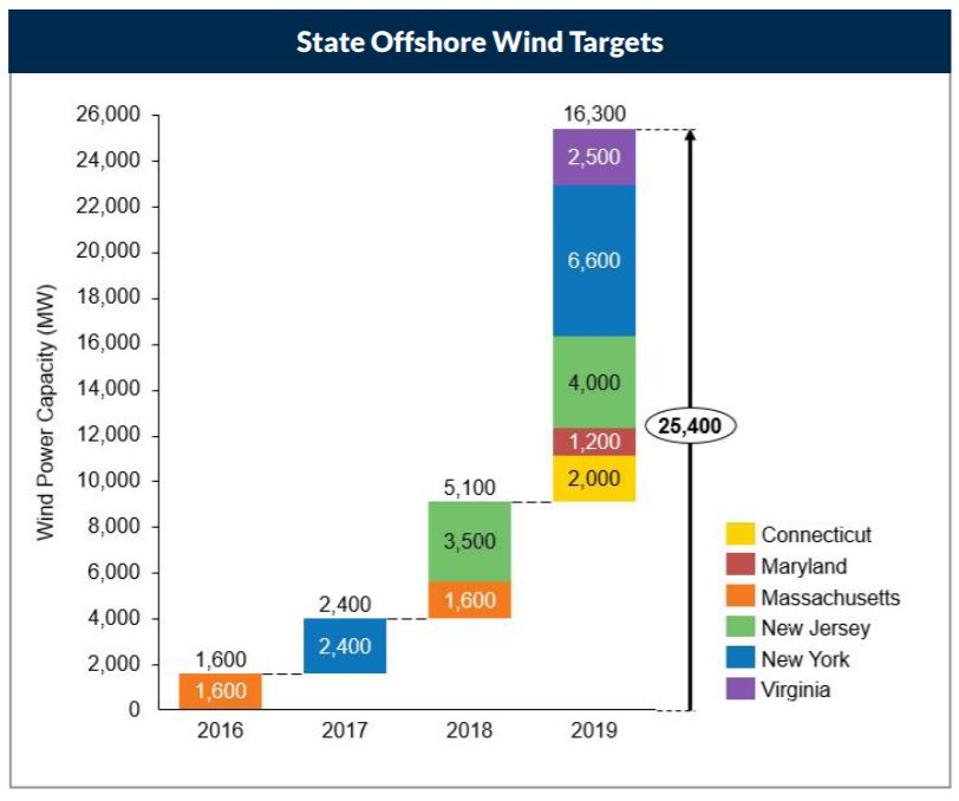

Despite 25.4 gigawatts (GW) of offshore wind commitments by Republican and Democratic governors along the East Coast, the Trump administration has delayed project approvals and offshore lease sales, threatening to slow this burgeoning growth.

Federal policymakers seeking high-paying jobs that can’t be outsourced and secure stable investment that revitalizes U.S. communities should consider four low-cost policy actions that could unlock offshore wind’s billion-dollar economic potential.

PROMOTEDGrads of Life BRANDVOICE | Paid Program

Work Rebooted: Preparing For The Future Of Work

UNICEF USA BRANDVOICE | Paid Program

8 Things To Know About The World’s Deadliest Cholera Outbreak

Civic Nation BRANDVOICE | Paid Program

Your COVID-19 Care Package From USOW

Offshore wind’s billion-dollar economic upside is already paying dividends

Offshore wind represents more than 2,000 GW of total energy resource potential for the U.S., or nearly double total national electricity use. States along the East Coast have capitalized upon fast-falling offshore wind technology prices in a “race to the top” competing to become regional hubs for the high-skill labor jobs that come from booming installations.

Europe’s success kickstarting the offshore wind industry demonstrates that it can generate affordable, reliable, and clean energy – and state policymakers have leaned into the technology in setting ambitious decarbonization targets.

The first U.S. operational offshore wind project, Rhode Island’s 30-megawatt Block Island Wind Farm, came online in December 2016, and the American Wind Energy Association (AWEA) forecasts up to 30 GW of offshore wind capacity will be operational by 2030.

Connecticut, Maryland, Massachusetts, New Jersey, New York, and Virginia have established goals to procure more than 25 GW of offshore wind capacity by 2035 and have approved more than 6 GW of projects as of February 2020.

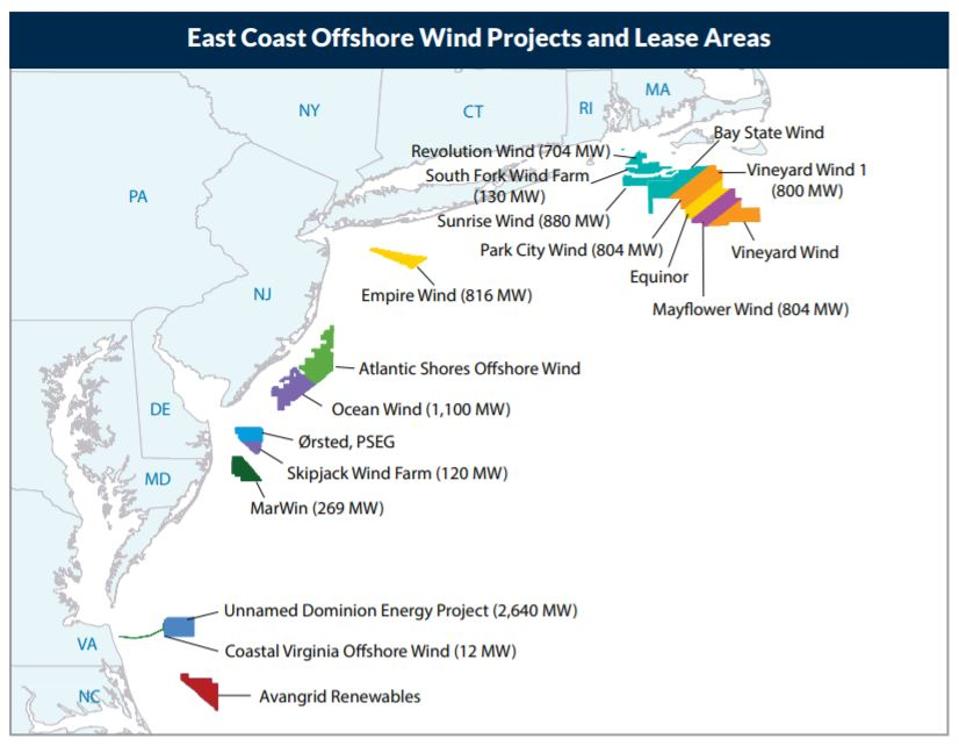

Projects are now in various stages of development across 15 offshore wind energy leases issued by the Interior Department’s Bureau of Ocean Energy Management (BOEM) and additional offshore wind lease auctions are planned for California, Hawaii, New York, and South Carolina.

AWEA estimates the offshore wind industry will invest between $28-$57 billion in the U.S. economy and support 45,000-83,000 jobs by 2030, depending on installation levels and supply chain growth.

This economic upside isn’t theoretical. Offshore wind developers have already announced $1.3 billion in transmission infrastructure, manufacturing facilities and supply chain development, and port infrastructure.

Brayton Point, a former coal plant in Massachusetts, is being redeveloped into an offshore wind port and manufacturing center with up to $650 million in investment. The Connecticut Port Authority has approved a $157 million plan to redevelop a 100-year old site in Hartford into a construction and manufacturing hub. An abandoned steel mill site in Baltimore has come back to life as a staging area for turbine assembly and could become a turbine manufacturing facility. Providence will soon be home to an innovation hub for one of the world’s largest developers. New Jersey could soon be manufacturing steel foundations for turbines.

AWEA notes that this economic opportunity spans 74 occupations, and will spread far beyond the East Coast, including manufacturing and service providers along the Gulf Coast region who contributed to the Block Island project.

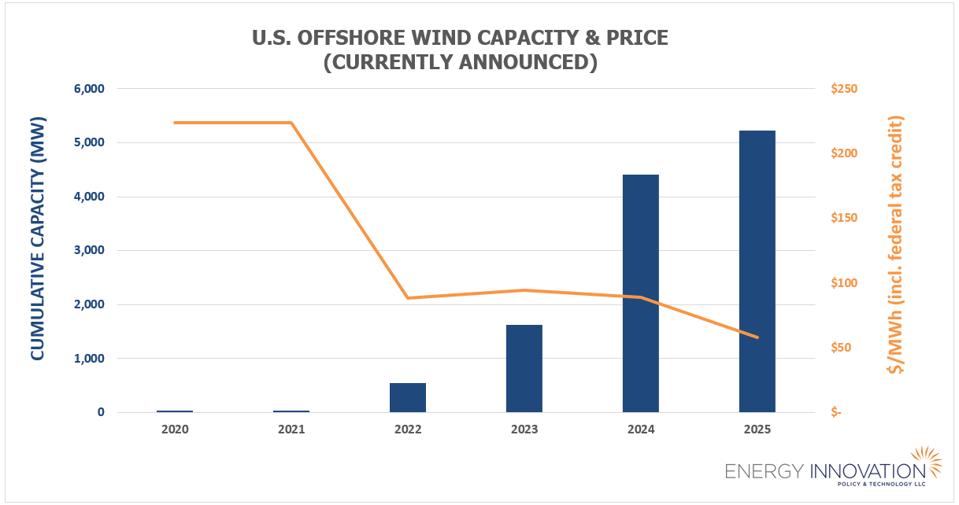

Offshore wind is already approaching cost-competitiveness with grid supplies in parts of the Northeast U.S., and as prices continue to fall, could lower costs for electric utility customers by reducing wholesale energy prices and natural gas demand – another form of ongoing economic stimulus.

Four low-cost federal policy actions could recharge the U.S. economy

So what can the federal government do to help offshore wind recharge the U.S. economy? Quite a lot, it turns out.

First, Congress could extend the Production Tax Credit (PTC) and Investment Tax Credit (ITC) safe harbor clause from four to six years for projects that commence construction between 2016-2020. AWEA also recommends Congress secure a direct pay provision equal to 100% of the PTC and ITC to address potential decreases in tax equity availability.

Second, BOEM could complete environmental impact reviews for offshore wind projects it is currently processing. Massachusetts’ Vineyard Wind, which will be the largest U.S. offshore wind project at 800 MW, was paused when BOEM delayed publication of its final decision late in 2019 for an expanded environmental review, even after passing initial reviews. This represented an about face after former Interior Secretary Ryan Zinke said he was “very bullish” on offshore wind and called it key to the administration’s “energy dominance” strategy in 2018.

Third, BOEM could identify potential wind energy lease areas and schedule sufficient future offshore lease sales to reach state goals. “A long-term pipeline of wind lease sales does not currently exist,” said Randall Luthi of the National Ocean Industries Association in 2018. The organization has recommended at least four 500 MW lease sales per year with an ultimate target of 20 GW of total lease sales by 2034.

Congress also has a role here, and could expedite BOEM’s processing of construction and operation permits by fully funding staff needs to review applications as requested in DOI’s 2021 budget. Liz Burdock of the Business Network for Offshore Wind noted “small businesses will need work immediately following the containment of the coronavirus, and next year may be too late to keep them solvent.” The group also noted BOEM could consider permits for project proposals simultaneously rather than sequentially.

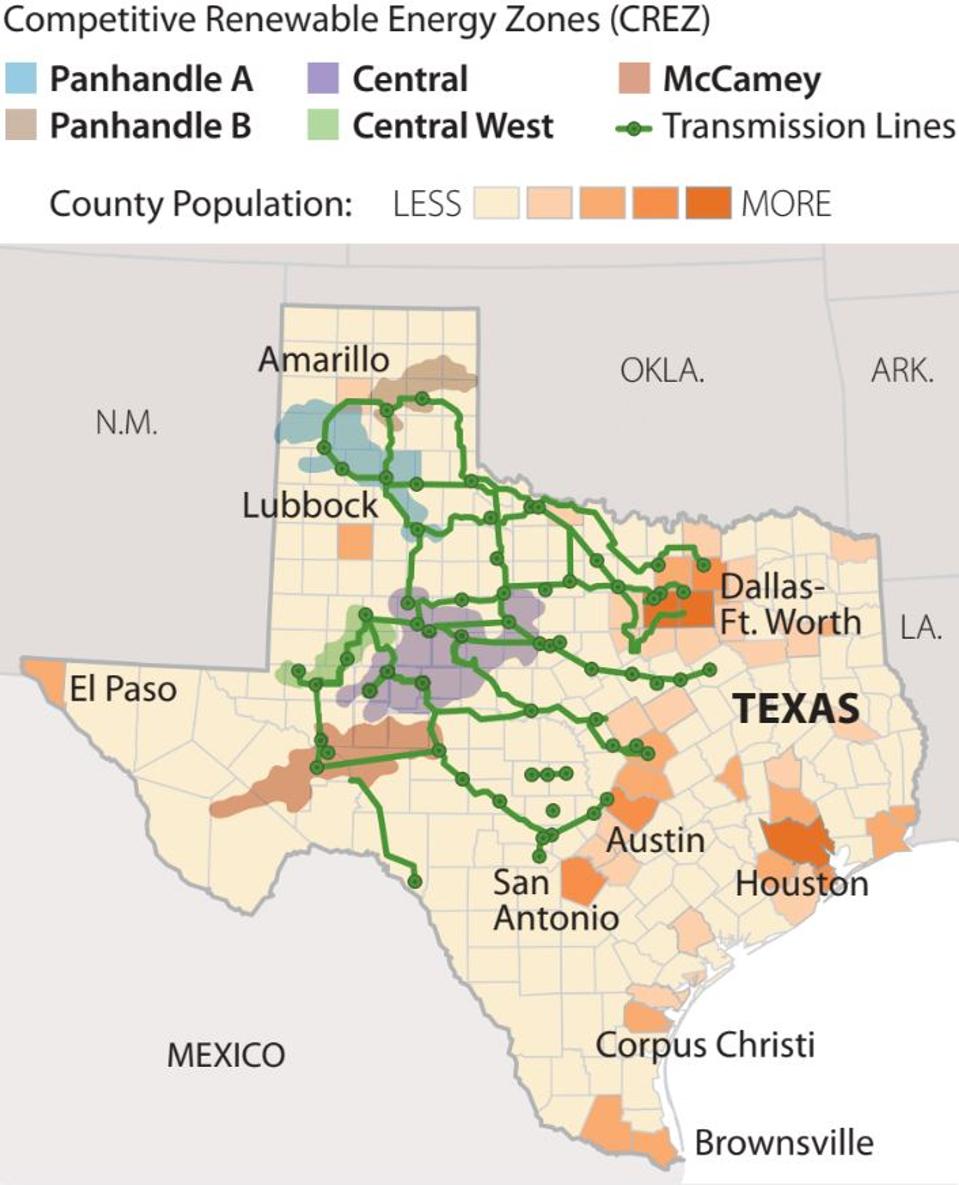

Fourth, transmission access is often a hurdle for wind energy projects, and BOEM could work with Northeast states and developers to coordinate an offshore transmission backbone for wind, similar to Anbaric Development Partners’ proposal to build up to 185 miles of offshore transmission to service Mid-Atlantic offshore wind farms. Texas’ CREZ transmission system, which spurred that state’s wind boom, shows how access to high-demand power markets attracts project development.

BOEM approved Anbaric’s legal, technical, and financial qualifications to acquire and hold a right-of-way grant on the Outer Continental Shelf in December 2019, but much more work will be required to bring this project – and others like it – online.

Offshore wind could “jump start” U.S. economic recovery

One policy lesson stands out for energy technologies, especially emerging ones like offshore wind – consistent and clear policy support spurs market development, which reduces costs and develops local supply chains.

“When the focus on the economy turns to recovery mode, the wind industry in general and offshore wind in particular is poised to jump start that movement with all the opportunities that exist,” said Laura Morton of AWEA via email.

As the federal government funds hundreds of billions in cash payments and loans to keep America’s economy moving now, it should also consider the myriad low-cost policy options available to keep the country’s clean energy economic engine from stalling out before the pandemic has passed.